st louis county personal property tax phone number

All City of St. Cities and counties may impose an additional local use tax.

A waiver or statement of non-assessment is obtained from the county or City of St.

. Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property. Louis MS 39520 Phone. St Louis County Assessor Clayton MO - 120 miles St Louis County Assessors Office Clayton MO - 120 miles St Louis County Assessors Office St.

Assessor Moultrie County Assessment Officer Moultrie County Courthouse 10 South Main St Suite 8 Sullivan IL 61951 Phone. Some Funds Are Subject to be Exhausted. Louis County District Court - Hibbing Hibbing Courthouse 1810 East 12th Avenue Hibbing MN 55746 Phone.

Search Moultrie County property tax and assessment records by parcel number owner name or street address and pay property taxes online. Assessor Collector Delinquent Taxes and Tax Sales. STL County Residents.

The St Louis County Assessors Office located in St. Louis County offers online subscription service to the real estate professional which provides access to the County Recorders real property records and the County Auditors property tax records by subscription service. A 10-digit number aka map book page and parcel that identifies each piece of real property for property tax purposes eg 1234-567-890.

To pay your LPT you will need your Property ID and PIN which were sent by Revenue before the valuation date 1 November 2021. California Relay Service A telecommunications relay service that provides full telephone accessibility to people who are deaf hard of hearing or speech impaired. They are also shown on any previous LPT correspondence you have received from Revenue.

Box 100 Hillsboro. The access fee is 18000 per month payable in. The state use tax rate is 4225.

Local sales tax to the cities counties and districts. If you do not have your Property ID and PIN you can use the LPT online service to request them. 228-467-6631 Fax 228-466-5696.

The assessment is made as of January 1 for the current years tax and is predicated on 33 13 of true value. If so we will refer you to a. Email 314 622-4111 More contact info.

Louis collector if you did not own or have under your control any personal property as of January 1. A 1984 statute by the Mississippi Legislature requiring a competent number of Justice Court Judges in each county eliminated the. Louis MO 63188.

Suite C Bay St. Your countys personal property tax records have not been provided to the department. IRS Tax Return 990 - 2021.

Louis County District Court. Louis MO - 186 miles. Hancock County Justice Court has jurisdiction over all actions for the recovery of debts or damages as well as personal property up to 3500.

Jefferson Department of the County Assessor PO. Property Tax Search and Pay Property Taxes. Charles County Property Records Search.

The Collector of Revenues office is responsible for collecting real estate and personal property taxes water-refuse bills and earnings and payroll taxes for the City of St. Even if the property is not being used the property is in service when it is ready and available for its specific use. Search Benton County property records by parcel number owner name address or PPIN including GIS maps.

Louis Missouri determines the value of all taxable property in St. Louis MS 39520 Phone 228467-4425. Information 247 Interactive Voice Response.

Per Missouri Revised Statute 137122 property is placed in service when it is ready and available for a specific use whether in a business activity an income-producing activity a tax-exempt activity or a personal activity. Search Harrison County real and personal property tax rolls by name. Heat Up St.

The amount of use tax due. Professional or personal telephone phone number employer name and location job title or area of expertise. Louis co UMB Bank PO.

Jefferson Department of the County Assessor Administration Center LL17 lower level 729 Maple Street Hillsboro MO 63050 Phone. Use tax is imposedon the storage use or consumption of tangible personal property in this state. Violations and enforce policies detect prevent or otherwise address fraud protect against harm to the rights property or safety of our users or the public protect your vital interests.

Paying your Local Property Tax. Louis taxpayers with tangible property are mandated by State law to file a list of all taxable tangible personal property by April 1st of each year with the Assessors Office. Individual Personal Property Declarations are mailed in January.

Find 6 Assessor Offices within 367 miles of St Charles County Assessors Office. Louis County District Court - Duluth Duluth Courthouse 100 North 5th Avenue West Duluth MN 55802 Phone.

Collector Of Revenue St Louis County Website

How Healthy Is St Louis County Missouri Us News Healthiest Communities

St Louis County Post Third Tax Sale List Youtube

Real Estate Investing The Best And Worst Markets For Property Taxes Romantic City St Louis St Louis Restaurants

St Louis County Minnesota Facebook

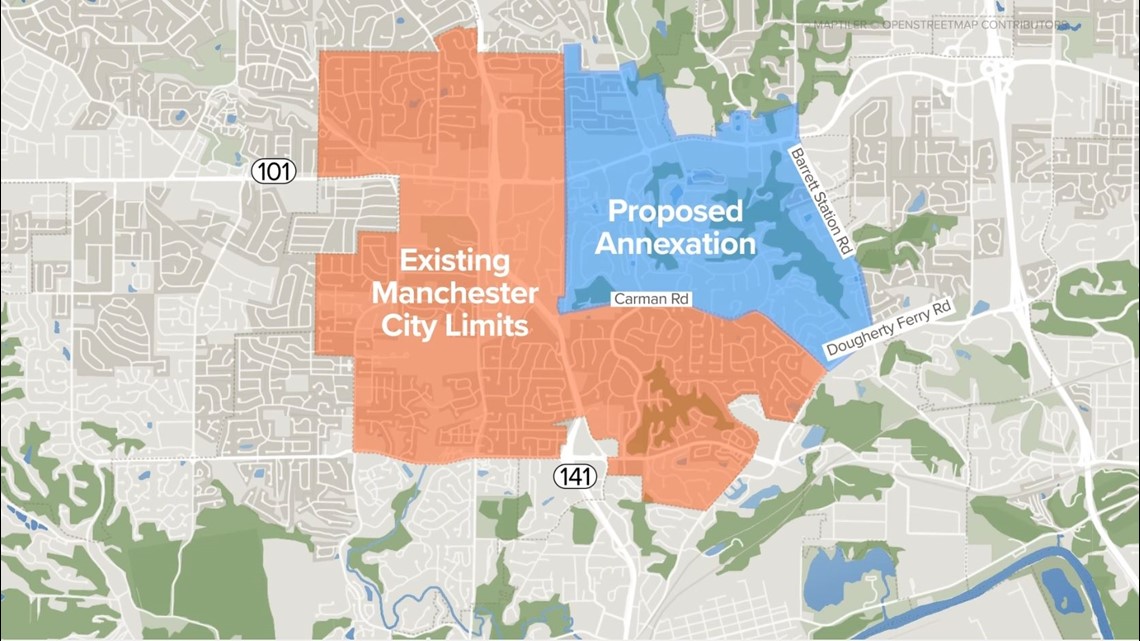

Manchester Seeks To Annex Unincorporated St Louis County Ksdk Com

Action Plan For Walking And Biking St Louis County Website

St Louis County Mo Stlcounty Twitter

Revenue St Louis County Website

St Louis County Executive S Chief Of Staff Abruptly Resigns Fox 2

St Louis County Municipalities And Better Together 4 Things To Know

Print Tax Receipts St Louis County Website

St Louis County Map Shows Coronavirus Cases By Zip Code Fox 2

County Assessor St Louis County Website

Amazon Com St Louis County Missouri Zip Codes 36 X 48 Paper Wall Map Office Products